A. Limited Company

A limited company refers to limited liability, meaning that if the company incurs debts during operations and is unable to repay them, generally, the company’s debts will not affect the personal assets of the shareholders.

When should you open a “Limited Company”?

- To achieve effective risk management

- When the company founders intend to expand the business

- When there is a possibility of introducing new investors or raising funds in the future

B. Unlimited Company

An unlimited company refers to unlimited liability, where in the course of business operations, if the company is unable to repay its debts, the owners/partners are required to bear unlimited liability.

Benefits of opening an unlimited company:

- Lower establishment and maintenance costs

- The structure of an unlimited company is relatively simple

- Simplified reporting requirements, with simpler financial statement requirements

- Tax flexibility

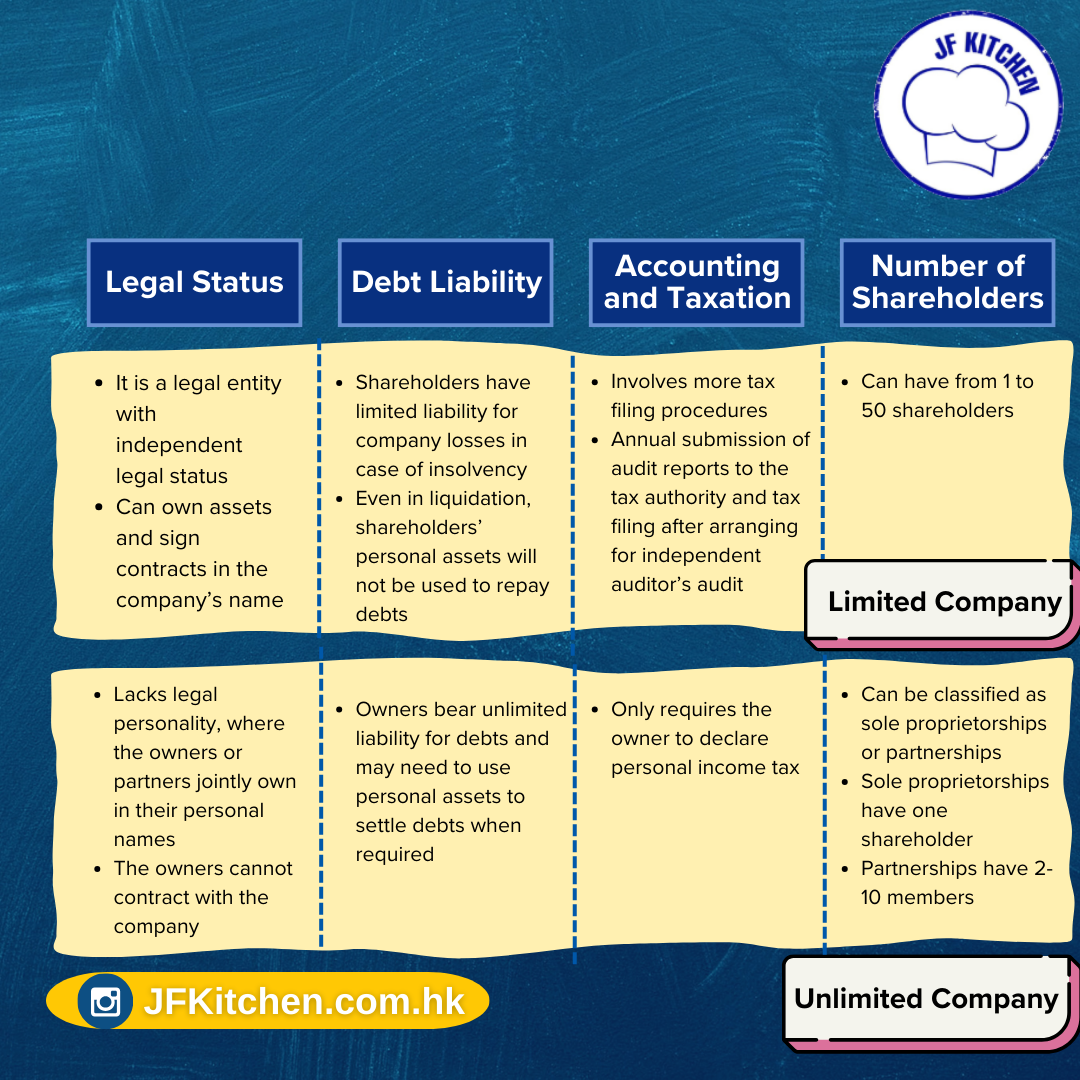

C. Comparison between the two

Legal Status

1) Limited Company

It is a legal entity with independent legal status, can own assets and sign contracts in the company’s name

2) Unlimited Company

Lacks legal personality, where the owners or partners jointly own in their personal names, and the owners cannot contract with the company

Debt Liability

1) Limited Company

Shareholders have limited liability for company losses in case of insolvency

Even in liquidation, shareholders’ personal assets will not be used to repay debts

2) Unlimited Company

Owners bear unlimited liability for debts and may need to use personal assets to settle debts when required

Accounting and Taxation

1) Limited Company

Involves more tax filing procedures

Annual submission of audit reports to the tax authority and tax filing after arranging for independent auditor’s audit

2) Unlimited Company

Only requires the owner to declare personal income tax

Number of Shareholders

1) Limited Company

Can have from 1 to 50 shareholders

2) Unlimited Company

Can be classified as sole proprietorships or partnerships

Sole proprietorships have one shareholder

Partnerships have 2-10 members